NZD/USD Price Analysis: Buyers will look for entry beyond two-week-old falling trendline

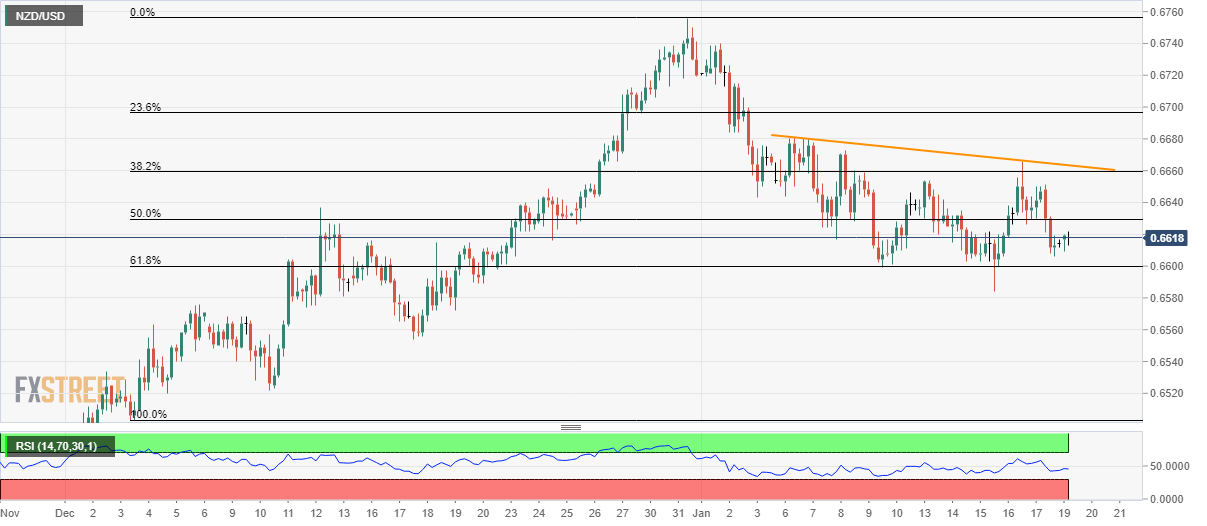

- NZD/USD stays above 61.8% Fibonacci retracement.

- 0.6700 will gain buyers’ attention beyond the resistance line.

NZD/USD takes rounds to 0.6620 during early Monday. The pair seems to recover from the intra-day low of 0.6606 but stays well below the short-term descending trend line. As a result, buyers will wait for a sustained break of the key upside barrier prior to taking entries.

Even so, 50% Fibonacci retracement of the pair’s run-up from December 04 to 31, around 0.6630, can offer momentum traders ahead of pushing them towards 0.6665 trend line resistance.

In a case where NZD/USD prices rally beyond 0.6665, 0.6700 will hold the keys to the pair’s further rise to the monthly high near 0.6740 and the December-end top of 0.6756.

Meanwhile, pair’s declines below 61.8% Fibonacci retracement level of 0.6600 can please sellers with December 18 low of 0.6554 whereas bottoms marked on December 18 and 04, around 0.6522 and 0.6503 respectively, will lure the bears afterward.

NZD/USD four hour chart

Trend: Bearish